By DataAnalytics

“Forward”

Merriam-Webster’s Definition of FORWARD:

1a : near, being at, or belonging to the forepart b : situated in advance

2a : strongly inclined : ready b : lacking modesty or reserve : brash

3: notably advanced or developed : precocious

4: moving, tending, or leading toward a position in front; also : moving toward an opponent’s goal

5a : advocating an advanced policy in the direction of what is considered progress b : extreme, radical

6: of, relating to, or getting ready for the future <forward buying of produce>

— for·ward·ly adverb

— for·ward·ness noun

Looking closely at definition number 5a, its meaning becomes particular interesting in certain contexts and uses of the word- Forward.

For example one could easily sight the apparent radical financial actions of the U.S. government

and its agencies over the past 12 to 13 years that had been steadily gaining momentum and now, rapidly accelerating during this particular administration.

As well as the extreme ideologies of both the republican and democratic parties, which has manifested itself in the form of massive and unchecked corporate pandering and financial welfare being handed out to large investment banks, large corporations, along with the continuing erosion of personal freedoms of the American citizen. As they had (the U.S. government) stated, their goal was to “fundamentally transform America” and indeed, seem to have succeeded.

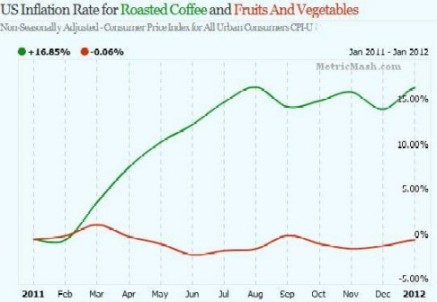

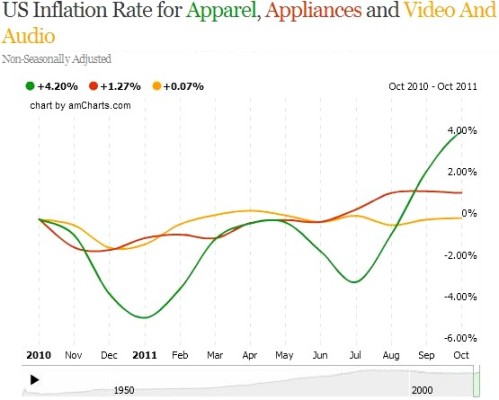

Definition 6, states; -get ready for the future, and in the case of the U.S. economy and the

immediate and mid-term future, it speaks more to the ‘get ready’ verbiage described. What it

does imply, is that the majority of United States citizens should be ‘getting ready’ for a future of a depressed economy, enormous fiscal/capital debt and monetary inflation, that well may last for a decade or possibly longer.

Now that we have established the various definitions of Forward, let’s examine the roots of the slogan “Forward” as a bureaucratic advertising catch-phrase.

The use of the word in the political realm is nothing new. In fact it dates back to the late 1800’s in the former Social Democratic Party of Germany. (which was an early Marxist-Based party platform)

Forward, or the German version, Vorwärts! Was a daily newspaper published originally in Leipzig from 1876 to 1878 and then again in Berlin from 1891 to 1933. Vorwärts! was the voice of the European Marxist-Socialist movement and ideology, before being outlawed and crushed by the so-called Fascists of the Nazi Party (also a Socialist ideology itself, just that it was a Right-Wing movement rather than a Left-Wing movement)

Subsequently, during the reign of Nazi totalitarianism, Vorwärts! Vorwärts! (Forward! Forward!) was the Hitler-Youth marching song designed to rally and unite the German people with national fervor from the emerging youth.

Forward, was also utilized by the Soviet’s in the early 1900’s. Translated from its Russian Marxist-Socialist political use, the term “Vpered” was the first Bolshevik weekly newspaper, published in Geneva from Dec. 22, 1904 to May 5, 1905.

The name of the newspaper was suggested by then future Soviet leader, Vladimir Lenin.

Vpered was also a radical and extreme Marxist organization within the Russian Social Democratic Party, from 1909 – 1912. The slogan and context of Forward in political propaganda terms was also heavily touted and used in the Post WWII GDR/DDR and Soviet Union.

In more modern times, the European and North American Socialists define Forward

as “The way forward for anti-capitalism.” The caveat though, is that the U.S. government is not outwardly anti-capitalist, but they are without question, pro-corporatist. On the surface it would

seem that they are champions of free-markets, but when you dig deep enough below that surface

the evidence reveals a completely different and alarming truth.

In essence, a Corporatist platform of capitalism, is really nothing more than a form of Market-Socialism. When one considers what the government has done with tax-payer money or ‘printed’ currency, to “Bail-Out” dozens upon dozens of supposedly free-market owned companies.

The list is lengthy to print, but anyone who is able to search the internet thoroughly, can find the long list of companies and corporations the U.S. government has ‘loaned’ tax-payer money to. Although these so-called loans were nothing more than ownership stakes in said entities. Thereby creating partially and loosely owned/controlled economies- which is one of the tenets of Market Socialism.

We will continue our look and discussion of Forward in Part II